Skylight Financial Group knows no two people are alike. They champion individuality and personality. They listen and get to know you in an in-depth way so that they understand what truly matters most to you when it comes to your interests, goals, and aspirations.

For this reason, Century Federal has chosen to partner with Skylight Financial Group to offer members a trusted, local option for financial planning services.

Financial planning is a dynamic process to help you make well-informed decisions about how you allocate your money so that you can achieve your financial goals in life. Skylight’s comprehensive and personalized financial planning process is designed to determine where you are now, where you want to be in the future, and provide strategies on how to help you get there.

Skylight will use the six key areas of financial planning – financial position, adequate protection, wealth accumulation strategies, retirement planning, tax reduction strategies, and estate planning – to tailor a financial plan that fits your needs.

Your journey with Skylight will begin with your advisor identifying your financial objectives and explaining the financial planning process. From there, you and your financial planner will work together to come up with a plan customized and ever-adapting to your needs.

Meet the CFCU Team at Skylight Financial Group.

A Look at Diversification

Allen Wastler

Allen Wastler is a former financial journalist with over 30-years of experience, including time at CNBC, CNN, and Knight-Ridder Newspapers.

POSTED ON MARCH 16, 2023

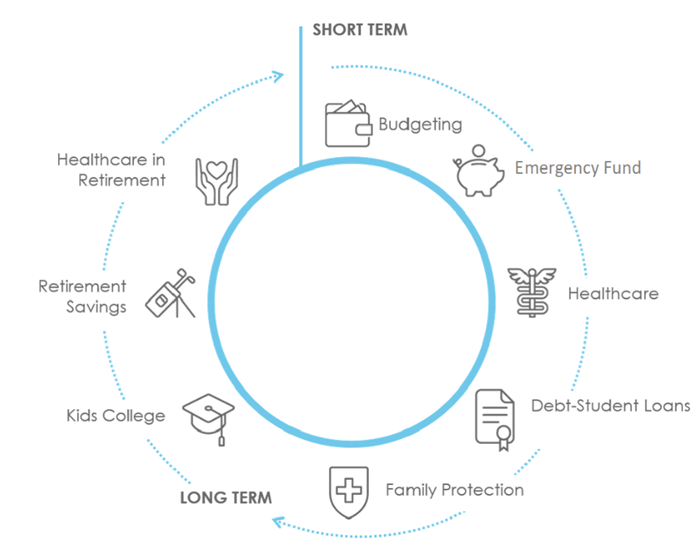

To be secure wherever you are on your financial journey, you need to focus on your short- and long-term goals.

That means handling day-to-day money tasks, like:

- Budgeting

- Building up emergency savings

- Paying down student loan or credit card debt

But it also includes considering long-term financial goals, such as:

- Saving for kids’ college

- Setting up a retirement plan

- Allowing for future health care costs

To balance these needs, it helps to have a financial game plan — one that allows you to get a clear picture of your financial reality and your financial goals. That way, you have an idea of the steps you need to take to stay financially well and secure.

One approach is to visualize your plan as a “financial wellness wheel” that shows the relation between your short- and long-term goals.

Understanding the relationship between your short- and long-term goals can help you determine priorities. Then ― taking advantage of the information, resources, and

solutions available to you ― you can make decisions and plans that you believe are right for you.

Short-term goals

Budgeting ―The first step in any financial wellness plan is setting up a budget. It is essentially a running account of what you are making, spending, and keeping over time ― and it is essential to good personal finance and wealth building. It should encompass not only day-to-day spending, but also account for saving and investing goals.

Emergency fund ― One of the first, early priorities in the wellness wheel cycle is to establish an emergency fund. This is a safety net to help pay the bills in the face of a job loss or an unexpected need, like a sudden repair cost or medical bill. Unfortunately, many people let this priority slip. Fifty-two percent of families responding to MassMutual’s 2018 State of the American Family survey had less than three months’ worth of readily available savings and 8 percent had nothing at all. The general recommendation is that if you are single, married with one income, or a business owner, you should have six months’ worth of expenses saved. For two income earners with steady incomes and jobs, the recommendation is to have three months’ worth saved.

Health care ― Illness or injury is a threat to anyone and everyone. Indeed, according to the Social Security Administration, a 20-year-old today has a one-in-four chance of being too ill or too hurt by injury to work at some point in their career.1 That’s why it’s important to have health care insurance in place. And some aspects of health care coverage these days, such as Health Savings Accounts, allow for additional benefits down life’s road. In the same vein, disability income insurance should be considered, especially if the loss of a paycheck over a significant amount of time could have negative consequences for you or your family.

Debt ― Paying off a student loan or wrestling with a credit card balance is a fact of life for many people. And sometimes debt is necessary to achieve certain goals in life, like purchasing a home. But without acknowledging and having a plan to deal with debt’s impact on your financial circumstances, it can spiral out of control. That’s why a debt management plan should be part of your financial wellness wheel.

Family protection ― As you continue along in your career, and with help from the steps above, the standard of living for you and your family is likely to improve and your assets grow. And so your financial wellness wheel will turn to protecting those gains and ensuring that your family can carry on in the event you are gone. Certain kinds of life insurance can offer options for other financial needs as well. (Learn more: Life insurance overview)

Long-term goals

College savings ― Attending a private four-year college or university can cost more than $49,000 per year on average, according to the College Board.2 If you want college to be an option for your children, and most parents do, then taking advantage of various college savings vehicles, such as 529 savings plans, should become part of your financial wellness wheel.

Retirement planning ― Today’s needs are important, but so are those that will come in your old age. To that end, planning for retirement early and taking advantage of retirement savings plans available to you are important spokes on the financial wellness wheel. That means looking at employer-offered retirement savings vehicles, like 401(k) plans, and other mechanisms to build your retirement savings.

Health care in retirement ― As you get older, your health situation is likely to become more complicated. That’s an added consideration in your retirement planning and something that should be considered when looking at options available to you, like life insurance with long-term care riders, during your working years.

Flexibility

Of course, the financial wellness wheel is only one way to approach financial planning. Some may prefer the concept of a financial pyramid or using a financial goals calculator. The point is to approach your finances with a plan that will allow you to work toward your goals and adjust as your life circumstances warrant.

Indeed, different parts of the financial wellness wheel will have different importance at different times. For instance, once you’ve built an emergency fund, money can be redirected to other savings goals (until your living standards rise to the point that the emergency fund needs a boost). Or college saving might wait until you have children. The point is financial wellness should mean financial flexibility, because finances should adapt to life, and not the other way around.

Virtual Office Hours

Our partners at Skylight Financial offer Virtual Office Hours on Tuesdays and Thursdays between 10pm and 12pm. Choose between a 15, 30, or 45 minute session with a CFCU Skylight team member.

Schedule your virtual appointment today!

Learn more by visiting the

Skylight Financial Group website or by calling 216.621.5680 and mentioning that you are a member of Century Federal Credit Union.

Investment Products and Services offered are: Not a bank or credit union deposit or obligation; Not FDIC or NCUA insured; Not insured by and federal government agency; Not guaranteed by any bank or credit union; and may go down in value.

Century Federal Credit Union receives compensation from MML Investors Services (MMLIS) and its affiliates for referring clients to MMLIS and its representatives. MMLIS's affiliates include Massachusetts Mutual Life Insurance Company (MassMutual), MML Bay State Life Insurance Company (MML Bay State), CM. Life Insurance Company (CM Life) and MML Insurance Agency, LLC (MMLIA). As a result, Century Federal Credit Union has an incentive to refer clients to MMLIS and its representatives.

For the products and services offered through MMLIS, Century Federal Credit Union will receive 24.5% of the dealer concessions, commissions and advisory fees received by MMLIS. For products offered through MMLIA, Century Federal Credit Union will receive a percentage (which will be determined at the time of purchase) of the compensation paid to the MMLIS representative. For all products offered by MassMutual, MML Bay State and CM Life, Century Federal Credit Union will receive a percentage (which will be determined at the time of purchase) of the compensation paid to the MMLIS representative.

Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. Century Federal Credit Union is not a subsidiary or affiliate of MML Investors Services and is not a current client. OSJ: 1956 Carter Road, Suite 200, Cleveland, OH 44113. 216-621-5680.

CRN202602-6558275